Merger – When two companies combine together to form one company, it is termed a Merger ofcompanies. The two companies end to exist and a new company is formed.

Acquisition – In the case of Acquisition, the acquiring company takes over the majority stake in the acquired company, and acquiring company continues to be in existence.

Merger and Acquisition - refers to either buying, selling, or merging business entities, with an objective to enable the company to grow, flourish and ensure the newly merged entity is more impactful with increased efficiency and productivity. The end result of a merger is to create more value for the entity post-merger.

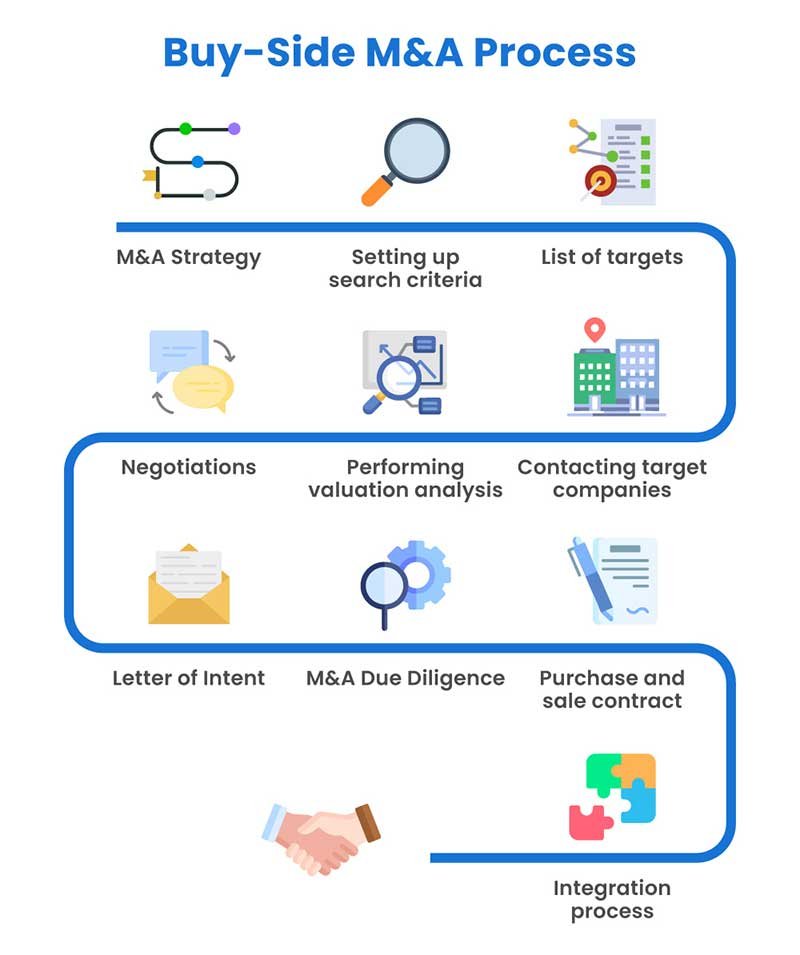

An M&A Advisory Firm acts as a consultant, guide, and coach for its clients and helps them throughout the process of mergers and acquisitions, and the services often also leverage all aspects of inorganic growth in an organization which helps in increasing the market share. An M &A Advisory Firm has a dedicated team of experts who work on behalf of their clients in attaining success right from the beginning to the closure of the deal. In other words, such firms guide companies and big business houses through various intricacies and complexities of mergers and acquisition deals. The whole process is a major point of concern for businesses involved in the deal, because the process may be embroiled with risk and uncertainty. However, with effective research and planning a good M&A Firm can turn this complex process into an easy, straightforward, and hassle-free experience.

Merger and Acquisition Advisory firms are companies that assist and provide necessary guidance and expertise to those companies that plan to either buy or sell or undertake complete restructuring of their firms. Such firms function like personal financial advisors and can prove to be a game-changer if they effectively execute the transaction on behalf of a company. The process of selling or restructuring a company is cumbersome and needs the help of experts. This is where M&A Advisory Firms come into play and such a firm can be aptly called a “ Business Coach” which can steer a company towards a successful corporate dealing. M&A Advisory Firms play a crucial role in this era of mergers and acquisitions ( or takeover) as it works out a feasible plan and offers their clients tailor-made solutions which simplify the process of mergers and acquisitions.

Quicker Turnaround: M&A Advisory Firms play an important role for clients. The biggest advantage is that hiring an M&A Advisory Firm helps in saving time. The company which hires it is not required to do research and everything on its own. The firm does it on the company's behalf. As the M&A Firm works out all nitty-gritty of mergers and acquisitions in a well-researched and calculated manner, the possibility of its success is high and cannot be ruled out.

Ensures Genuine Buyer: Usually, M&A Advisory Firms have a lot of contacts and business connections that help in getting a suitable buyer. They try and headhunt genuine buyers which would have been difficult for its client to get otherwise. Being a professional body one can trust and rely on the M&A Advisory Firm experts who can find a genuine and bonafide buyer for the business.

Helps in Negotiating Better Price for the Company: M&A Advisory Firm helps a company enter into a right and worthy deal. Their expertise in analyzing the business potential, gauging the market interest and potential buyers’ interest work together to complete the transaction at the best possible sale price.

Stress-free process: It is ideal to shift the stress and hassles of the tedious processes of an M&A transaction to the expertise of an M&A Firm. Delegating these tasks to a professional M&A firm can free you from unnecessary worries about these complex transactions. A highly professional M&A Firm will always try to get you the best deal possible with ease.

Aerosoftspartners with businesses to assist with all aspects of mergers, acquisitions, and divestitures.